How Private Wealth Managers benefit from Wealth Management Software

Wealth Management Software offers Family Wealth Managers with a simple solution to achieve better visibility and control of their enterprise operations.

What is Wealth Management Software?

Wealth Management Software combines financial services and asset management tools to make managing your wealth simpler. Financial advisors can gather insights and tailor a customisable strategy for clients using a range of financial products for different business processes so Family Wealth Managers are able to manage individual, group or family investments simultaneously.

Wealth Management Software can be used for accounting and other financial services such as: commodities management, tax compliance, IRR (Internal Rate of Return) reports for both individuals and businesses.

How does Wealth Management Software help Private Wealth Managers?

Wealth Management Software meets client’s needs, protects their investments whilst being a quick and efficient tool. Some of these features include:

1. Better Control and Visibility Over Multiple Portfolios

Wealth Management Software can give investors better decision making options over all their investments from on platform with powerful portfolio aggregation and flexible consolidated holdings. Wealth managers can have a complete picture that allows them to make better investment decisions.

2. Smart Portfolio Aggregation and Real Time Data to Inform Investment Strategies

A good diversification strategy can prevent any potential or unforeseen risks from affecting your investments. Wealth Management Software like Family Wealth Guru provide clients with immediate access to their real time investment data and provide performance metrics to help drive better decision making.

3. Decreased Costs for Family Wealth Managers

Wealth Management software solutions reduce manual processes via auto-updates, single screen entries and flexible portfolio aggregation. This eradicates human error. This is a cost-effective solution that gives a quick ROI.

Why choose Family Wealth Guru for your wealth management needs?

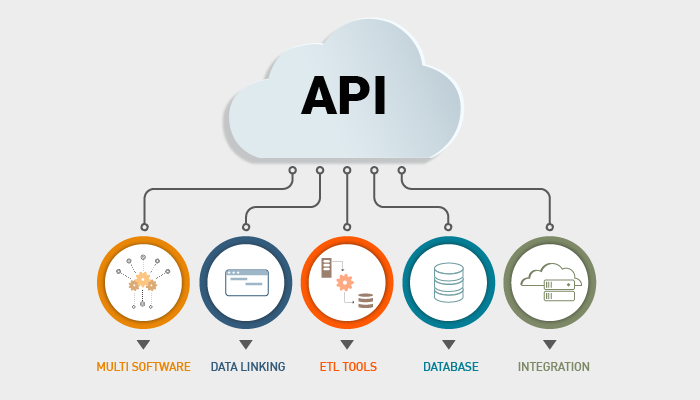

Family Wealth Guru seamlessly integrates with our flagship software FACT ERP.NG so you can manage your entire wealth management operations from one system. Some features include: integrated wealth management with portfolio aggregation, better data security, mark-to-market reports that are ideally suited for Family Offices and Family Wealth Managers.

Our Wealth Dashboards have additional features such as automatic updates of financial data so you can create target percentages for asset management, prepare tax returns and track IRR for all your commodities in one system. This way you can access your data through all your portable devices.

Our Quality Assurance Statement is proof of our commitment to providing dependable services as we always aim to resolve software issues immediately, so that you can continue to use our award-winning products effortlessly.